Looking for information about commercial solar tax relief? As the world is increasingly focusing on sustainable and renewable energy sources, businesses are looking for ways to invest in clean energy while also saving money. One of the best ways to do so is through commercial solar panels in the UK.

Not only can they provide businesses with a sustainable source of energy, but they can also provide various tax incentives to reduce the overall cost of installation.

Tax Relief on Commercial Solar PV

In this article, we’ll discuss the tax relief incentives that businesses in the UK can take advantage of. Helping you to make the best return on investment when installing commercial solar panels.

Super Tax First Year Allowance (FYA)

The Super Tax First Year Allowance (FYA) is a tax relief that allows businesses to claim 50% of the cost of their commercial solar panel installation. This is against their taxable profits in the first year. This means that businesses can write off a large portion of the cost of their solar panel system in the first year of ownership, instead of having to spread the cost over several years through capital allowances. The Super Tax FYA is a great way for businesses to reduce their tax bill and improve their cash flow, making solar panels an even more attractive investment for commercial properties.

Business Rates Relief

Businesses that install commercial solar panels may be eligible for Business Rates Relief. This relief can reduce the amount of business rates that the company has to pay on the property where the solar panels are installed. In some cases, the relief can be as much as 100% for a period of up to five years.

Smart Export Guarantee (SEG)

The Smart Export Guarantee (SEG) is a scheme that replaced the Feed-in Tariff for new solar panel installations in the UK. The SEG provides businesses with payments for the excess electricity they generate and export back to the grid. This scheme enables businesses to receive payments for any unused solar energy, incentivising businesses to invest in solar panels to reduce their energy costs and carbon footprint. Under the SEG, businesses are paid for every kWh of unused solar energy they export back to the grid, with the rate set by energy suppliers. The SEG is a great opportunity for businesses to generate additional income and make a positive impact on the environment.

Commercial Solar Installation in the UK

Installing commercial solar panels can not only provide businesses with a sustainable source of energy but also a range of tax incentives to reduce the overall cost of installation. With the government’s ongoing commitment to renewable energy, businesses can benefit from these tax reliefs while also contributing to a cleaner and greener future. It is always recommended to consult with a tax professional for specific advice on claiming tax relief for commercial solar panels.

Contact Novus Energy today to discuss your business requirements and find out how we can help you save thousands on your energy bills.

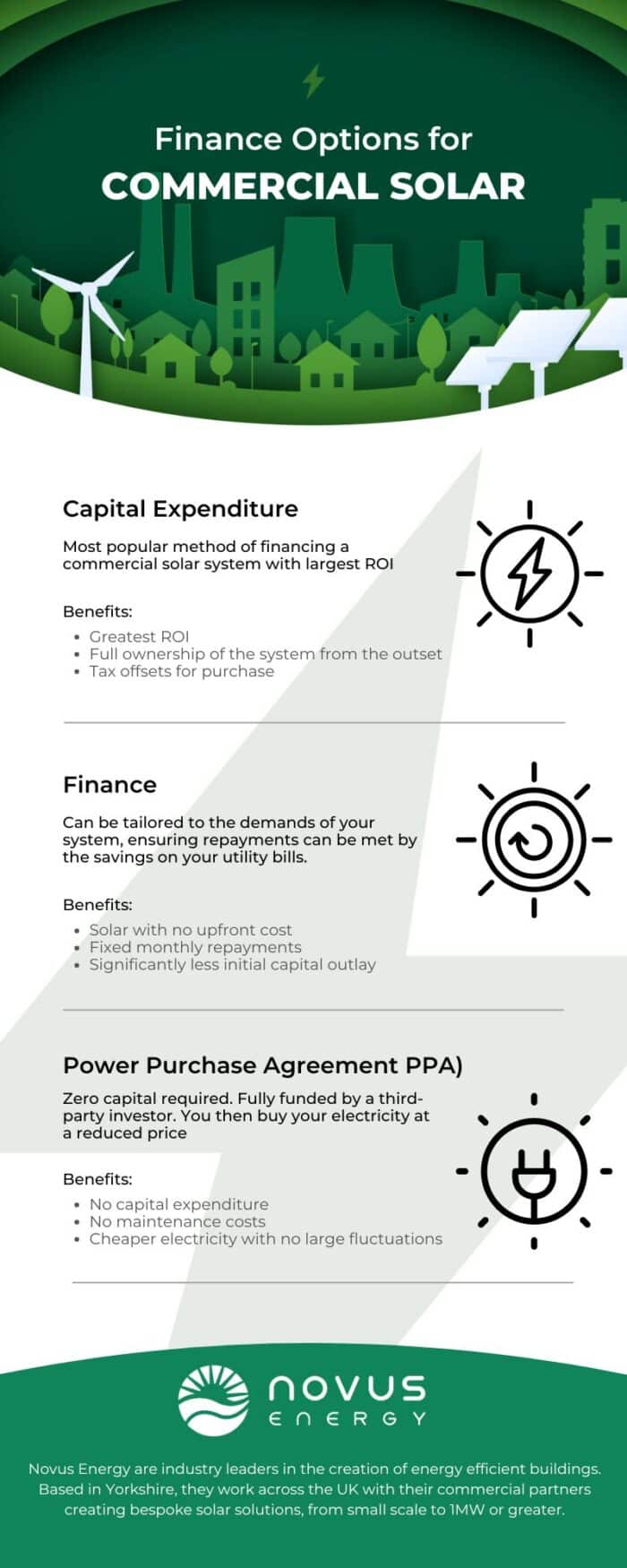

Finance Options for Commercial Solar

We offer a full design and installation service for commercial solar systems across the UK. Our team brings over a decade of experience and work with reputable partners and innovators in the sector to deliver cutting edge systems while maximising return on investment.